Ethereum's Rise in Capital Allocation Suggests a Potential Altcoin Upturn as Bitcoin's Influence Wanes

Altcoins Could Be the Next Big Thing: Ethereum ETF Inflows Shine Light on a Potential Rally

Empower your crypto journey with our daily newsletter* * Subscribe now!*

It's time for altcoins to shine as Ethereum [ETH] ETF inflows reach a record high

In recent happenings within the crypto sphere, Ethereum [ETH] has stolen the show by outperforming Bitcoin [BTC] in inflows to Exchange-Traded Funds (ETFs). This development has left enthusiasts buzzing, as it highlights a potential relief rally for the altcoin market.

According to Tracy Jin, the COO of MEXC exchange, the ETF divergence is a clear sign of market rotation that could hoist Ethereum and top altcoin gems. Jin explains,

Over the past two weeks, Ethereum's ETFs have experienced 11 consecutive days of inflows amounting to over $630 million, while Bitcoin ETFs have bled over $1.2 billion in three consecutive days of outflows.

Even though Bitcoin ETFs rebounded on Tuesday, Ethereum still led the scene earlier in the week, with a total inflow of $187 million.

Will we witness a shift in power from BTC to altcoins?

Jin's observations show that the Ethereum outperformance has sparked a slight relief bounce for select altcoins like Monero [XMR], Ethena [ENA], Hyperliquid [HYPE], and Arbitrum [ARB].

Interestingly, these altcoins have posted gains exceeding 5% during Tuesday's recovery rally, in stark contrast to Bitcoin's meager 0.6% growth.

Does the broader sector share the same fate?

The commotion surrounding Ethereum's outperformance has sparked discussions about the future of the altcoin market. In particular, there's some excitement surrounding the wavering Bitcoin [BTC] dominance in recent weeks.

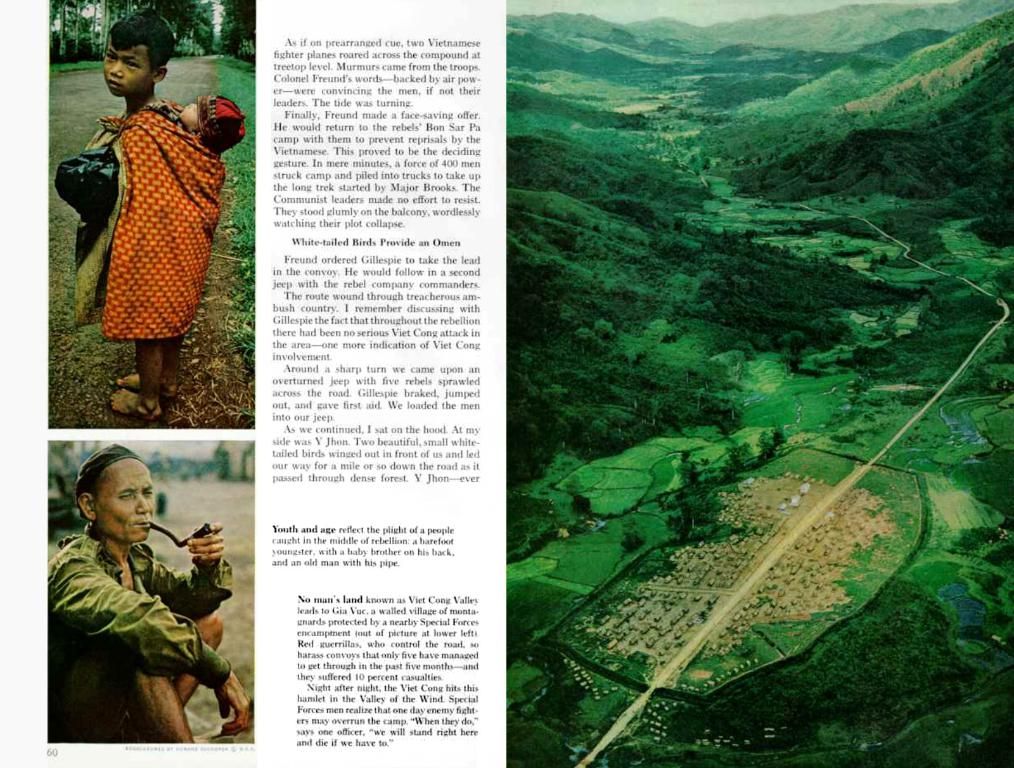

Since early May, Bitcoin dominance has hovered around 63%, but it has eased slightly by 1% in June. While it hasn't dipped as significantly as the golden era of altcoins, some expect that a further drop could boost the altcoin sector.

However, it's essential to recognize that not every altcoin will outshine Bitcoin in a potential new altcoin season. Sector performance, as of the last 30 days, reveals that DeFi, memecoins, and L1 tokens have been the top performers, while most L2 tokens have trailed behind.

This means that investors may benefit from creating an altcoin portfolio with leaders from the top-performing categories if an altcoin pump happens as expected.

In conclusion, the positive trends invite optimism about a broader altcoin season in the remaining part of 2025, with increased interest from institutional investors playing a significant role.

Stay tuned for more updates on this exciting development in the crypto world as the conditions converge.

Sources: [1] - Soso Value[2] - TradingView (Bitcoin dominance)[3] - Velo[4] - CoinShares Research

Against the backdrop of recent developments, the crypto market might be on the cusp of a new phase, inviting investors to keep a watchful eye for opportunities and adjust their strategies accordingly.

The surge in Ethereum ETF inflows could signal a potential rally for altcoins, as Ethereum outperforms Bitcoin in inflows to Exchange-Traded Funds.Tracy Jin, COO of MEXC exchange, states that the ETF divergence is a sign of market rotation that could lift Ethereum and top altcoin gems such as Monero, Ethena, Hyperliquid, and Arbitrum.These altcoins have shown gains exceeding 5% during the recovery rally, contrasting Bitcoin's meager 0.6% growth.Jin predicts that a further reduction in Bitcoin's dominance could boost the altcoin sector, but it's crucial to note that not every altcoin will outshine Bitcoin in a potential new altcoin season.Investors may benefit from creating an altcoin portfolio with leaders from the top-performing categories, such as DeFi, memecoins, and L1 tokens, in anticipation of an altcoin pump in the remaining part of 2025.