Gameplan for 2025 retail success: Formulating a thriving online sales strategy

New and Improved Retail Strategy for a Successful Sales Season

With the dust settling on the record-breaking 2024 holiday shopping season, retailers are diving deep into the data, dissecting every transaction, click, and customer interaction to build a roadmap towards a winning sales strategy for the following season. The key to success? Analyzing the wins and pitfalls of the past to optimize every aspect of the customer journey, from igniting initial interest to providing post-purchase support.

The checkout process takes center stage in retailers' scrutiny due to its direct impact on sales conversion rates. Even minor delays during this critical stage can trigger a sharp increase in cart abandonment – with 48% of shopping carts dropping, according to one study, due to excess shipping fees and taxes. This highlights the need for a smooth, efficient, and transparent checkout experience.

The root cause of bottlenecks often lies within the backend systems. Tax engines, pricing tools, and eCommerce platforms must be seamlessly integrated to handle real-time, complex calculations such as sales tax, VAT, and GST. To address this issue, businesses must prioritize optimization for both speed and accuracy using advanced technology that efficiently manages dynamic tax rates and rules, minimizing delays and errors. Simplifying the checkout process is also essential, with an emphasis on eliminating unnecessary steps and upfront, clear communication of all costs, including taxes and additional fees.

Sovos' Tax Determination software has proven its effectiveness in handling large transaction volumes, processing nearly 300 million real-time tax calculations during Black Friday and Cyber Monday 2024, significantly outperforming retailers relying on outdated systems struggling under high demand. This stark difference underscores the importance of modernizing checkout processes to create a seamless customer experience and secure sales.

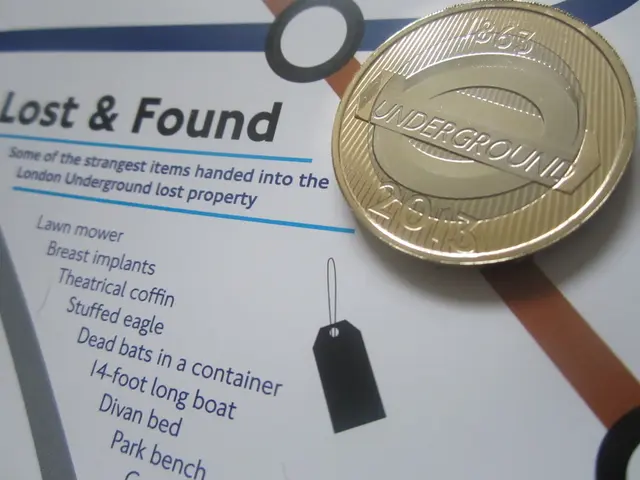

Post-holiday challenges don't end with the whirlwind of Black Friday and Cyber Monday. The 2024 holiday return rate jumped by 28%, resulting in a staggering $128 billion in returned merchandise[3]. Robust systems capable of handling the complexities of post-transaction adjustments are essential, particularly when it comes to tax reconciliation for refunds. Efficient software solutions must integrate with existing financial systems to permit automatic recalculations of taxes owed, ensuring compliance with state and federal tax laws.

In essence, compliance is retail's best investment. Forward-thinking retailers understand the potential of robust compliance strategies as a competitive advantage, enabling them to capitalize on obstacles as opportunities in the upcoming 2025 sales season. Rather than merely asking "How did we do?", retailers should focus on "How can we turn challenges into victories?" By proactively investing in refining their systems, retailers will be best positioned to meet customer expectations and conquer the dynamic retail landscape.

Proven Strategies for Optimizing eCommerce Checkout

To minimize friction points and optimize the customer experience during high-traffic shopping events like Black Friday and Cyber Monday, retailers can implement the following strategies:

- Streamlined Checkout Process

- Reduce the number of steps and ask for only essential information.

- Implement autofill features to speed up form completion on both desktop and mobile devices.

- Develop a clean multi-step checkout with progress indicators to keep customers informed.

- Flexible Guest Checkout and Social Logins

- Offer guest checkout without mandatory account registration.

- Provide various social login options, such as Google, Facebook, and Apple, for swift access.

- Display prominent "Continue as Guest" buttons to encourage swift checkout.

- Multiple Payment Options

- Offer a variety of payment methods, including credit/debit cards, digital wallets, and buy-now-pay-later services.

- Allow customers to save preferred payment methods securely for faster future checkouts.

- Reassure buyers with clear payment confirmation messages.

- Trust Establishment

- Show SSL badges and security certifications prominently to ensure a secure transaction.

- Display return policies and guarantees to reduce buyer hesitation.

- Offer real-time customer support during checkout to address any last-minute questions or issues.

- Free Shipping Incentives

- Promote free shipping, ideally with a minimum order threshold, to incentivize higher cart values.

- Communicate free shipping offers early in the shopping journey and during limited-time sales events.

- Optimization for Mobile Compatibility and User Experience

- Ensure checkout processes are optimized for mobile devices.

- Adopt a clear visual hierarchy, grouping information logically and making call-to-action buttons prominent.

- Offer editing options for cart items to avoid users needing to backtrack.

By implementing these best practices, retailers can reduce friction points, build trust, and meet customer expectations effectively during high-traffic shopping events, ultimately minimizing cart abandonment and maximizing sales conversions.

- Retailers, following the successes and pitfalls of the past, aim to optimize every aspect of the customer journey in the upcoming sales season, emphasizing the checkout process due to its direct impact on sales conversion rates.

- With 48% of shopping carts being abandoned due to excess shipping fees and taxes, there is a need for a smooth, efficient, and transparent checkout experience.

- The inefficiencies in the checkout process often stem from the backend systems, necessitating the integration of tax engines, pricing tools, and eCommerce platforms to handle real-time, complex calculations.

- Businesses should prioritize optimization for speed and accuracy using advanced technology that manages dynamic tax rates and rules, minimizing delays and errors.

- Simplifying the checkout process is also essential, with an emphasis on eliminating unnecessary steps and upfront, clear communication of all costs, including taxes and additional fees.

- Sovos' Tax Determination software was effective in handling high transaction volumes during Black Friday and Cyber Monday 2024, processing nearly 300 million real-time tax calculations.

- Post-holiday challenges include efficiently handling complexities of post-transaction adjustments, particularly tax reconciliation for refunds, to ensure compliance with state and federal tax laws.

- Compliance is retail's best investment, with forward-thinking retailers capitalizing on robust compliance strategies as a competitive advantage, turning obstacles into opportunities in the upcoming sales season.