Global Payment Platform Stripe Introduces Stablecoin Accounts Across Over 100 Nations

Swingin' into the future of finance, Stripe is shaking things up in the world of business money management. After all, who says online payments have to be limited? Not this fintech titan, that's for sure.

Stripe has catapulted itself into new territories, offering dollar-pegged cryptocurrencies like USDC and USDB through stablecoin-funded accounts in over 101 countries. Sounds fancy, right? Well, it's more than just a buzzword. It's a game-changer for international commerce.

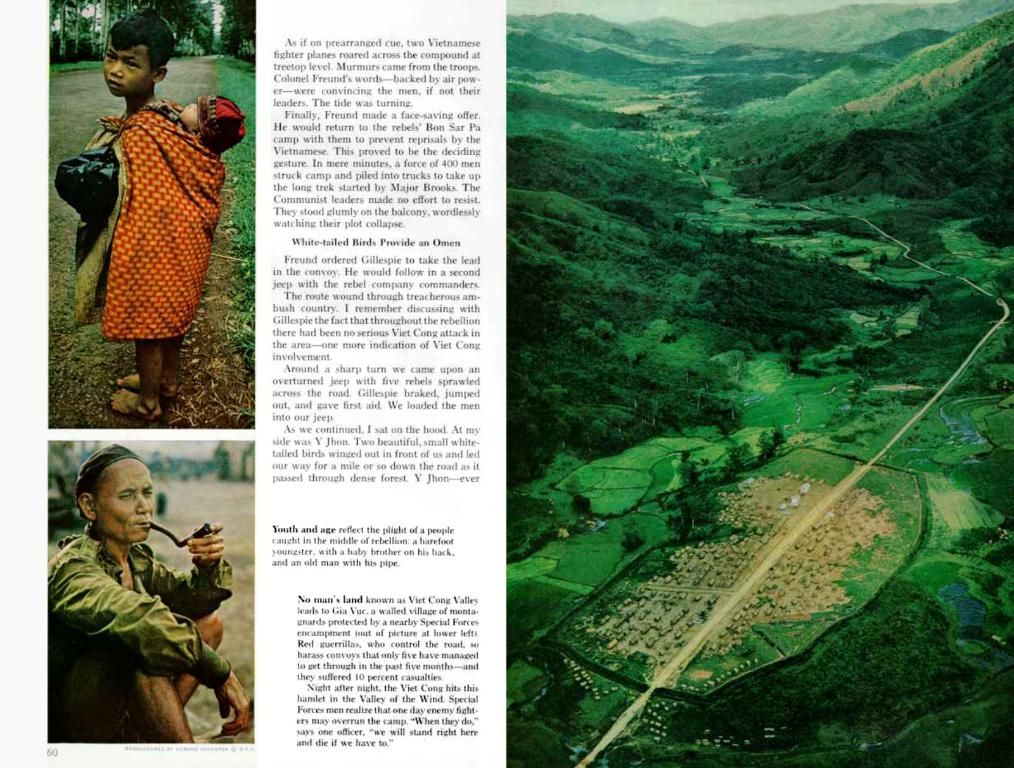

Before, only businesses in 50 countries could drool over Stripe's financial accounts. Now, with this rolling out, businesses worldwide can rock out those savings in US Dollars, even in countries with volatile currencies or shoddy financial infrastructure.

William Gaybrick, Stripe's president of product and business, spilled the beans, saying, "Businesses in those 101 countries can now hold stablecoins, receive, and send funds like a boss - even in regions that would give a struggling Argentine peso a run for its money."

As if that wasn't enough, these new accounts support balances in pounds, euros, and dollars, giving businesses the flexibility to float like a butterfly and sting like a bee in the world market.

The backbone of this moveoverseas is Bridge, Stripe's affordable new BFF. This stablecoin management software, bought for $1.1 billion last December, supports the new accounts and is the heart of Stripe's mission to make money flow easier, faster, and more globally than Paula Abdul in her heyday.

But Stripe isn't one-trick pony. The company's also unveiled a "profiles" feature to help businesses find and verify each other with the ease of a cat and its nine lives. And get this - Stripe revealed a developer tool that lets businesses embed AI agents into their apps.

Now, these AI agents can shop and drop purchases at the speed of sound, potentially revolutionizing productivity apps and turning shopping into a snap. Hey, who said business had to be boring?

Now, for the real icing on the cake: Arizona has become the second US state to pass a Bitcoin reserve bill! Jackpot, anyone?

Also Read: Arizona Becomes 2nd US State to pass Bitcoin Reserve Bill

[Sources]

- Stripe Cooks Up an AI Model for Improved Payment Fraud Detection. (2022). The Block Crypto. Retrieved from https://www.theblockcrypto.com/post/97646/stripe-cooks-up-an-ai-model-for-improved-payment-fraud-detection

- Stripe Partners with Nvidia to Deepen AI Integration Across Services. (2022). The Block Crypto. Retrieved from https://www.theblockcrypto.com/post/96071/stripe-partners-with-nvidia-to-deepen-ai-integration-across-services

- Stablecoins: The Future of Cross-Border Payments? (n.d.). Global Legal Insight. Retrieved from https://www.globallegalinsight.com/practice-areas/bianca-iberti/articles/africa/south-africa/stablecoins-the-future-of-cross-border-payments

- Stripe Partners with Visa to Create Global Card Issuing Product for Stablecoins. (2021). The Block Crypto. Retrieved from https://www.theblockcrypto.com/post/87678/stripe-partners-with-visa-to-create-global-card-issuing-product-for-stablecoins

- Stripe Brings Card Payments to Stablecoins with New Global Card Issuing Product. (2021). TechCrunch. Retrieved from https://techcrunch.com/2021/09/15/stripe-brings-card-payments-to-stablecoins-with-new-global-card-issuing-product/

- Stripe's innovation doesn't stop at dollar-pegged cryptocurrencies; they've also dabbled in AI, such as the development of an AI model for improved payment fraud detection.

- As Stripe extends its reach, it's also partnering with tech giants like Nvidia to deepen AI integration across services, aiming to streamline its operations further.

- The potential of stablecoins in cross-border payments is a hot topic, with experts suggesting they might become the future of international transactions.

- In a strategic move, Stripe partnered with Visa to create a global card issuing product for stablecoins, paving the way for wider acceptance of cryptocurrencies in the business world.

- Building upon these ventures, Stripe introduced a new global card issuing product that allows businesses to accept card payments in their stablecoin accounts, bridging the gap between cryptocurrency and traditional finance.