Increase in Ripple (XRP): Underlying Reasons Explored Today

Blockchain Buzz: XRP Records a Gain of 7.7%, Crosses $2.34

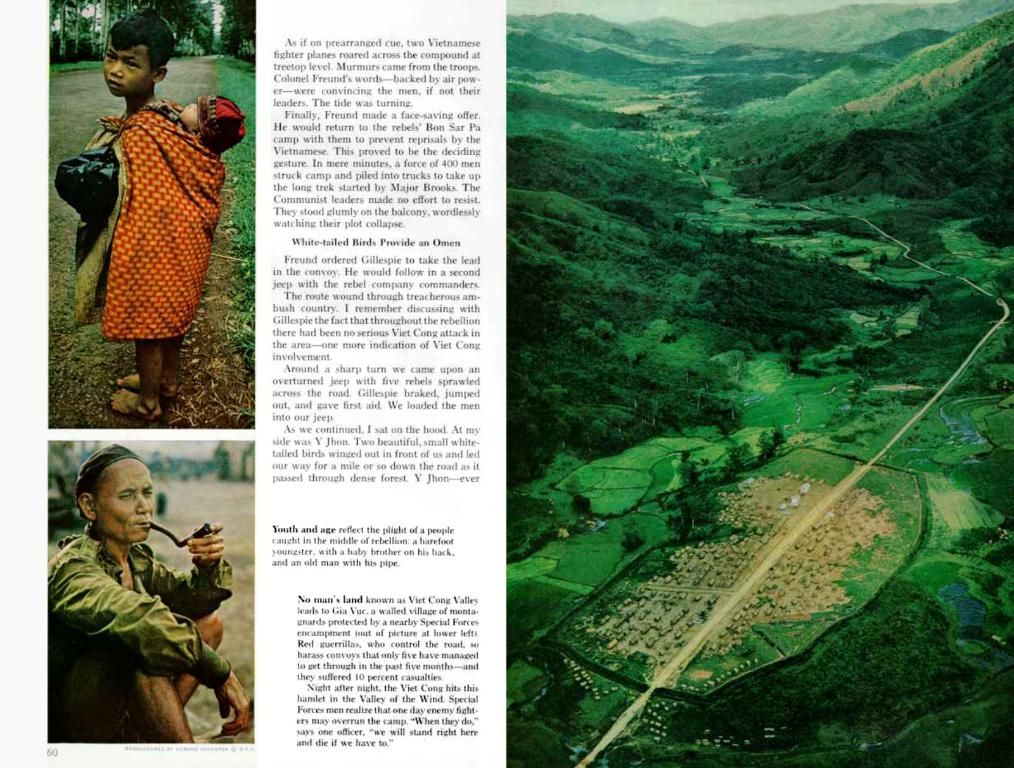

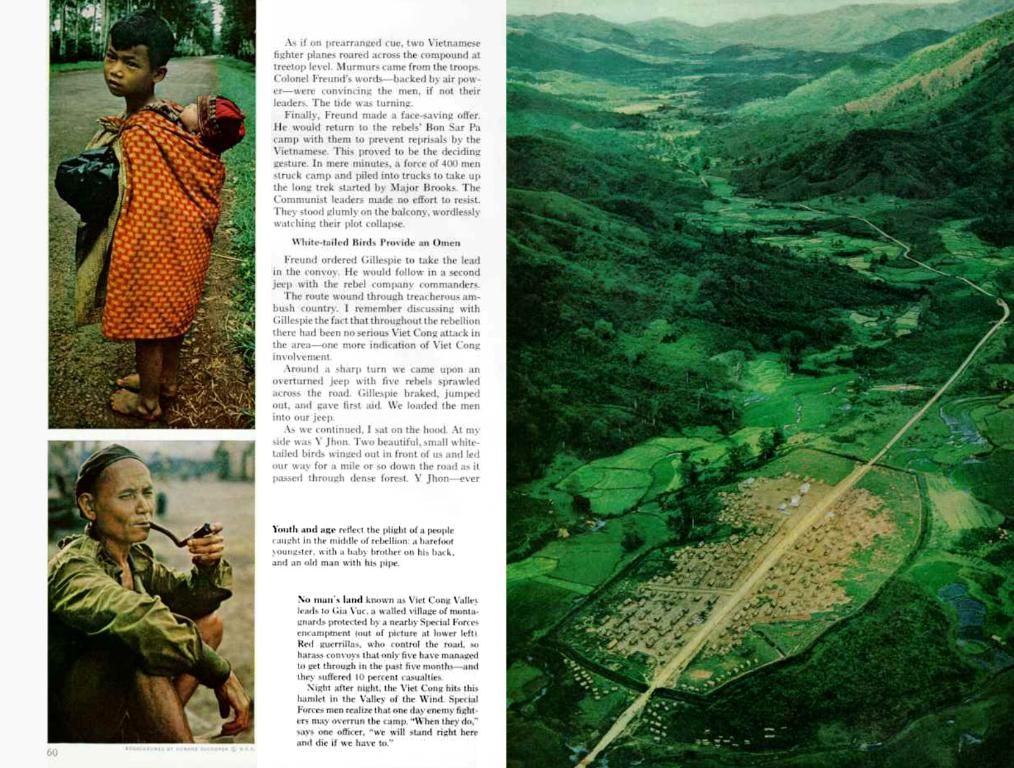

The cryptocurrency market is heading north, and XRP, the digital currency of Ripple, is leading the pack among top cryptos. This surge in XRP can be attributed to significant developments in ETFs. However, these developments aren't quite what the XRP community was anticipating.

The weekend was calm for Bitcoin and most altcoins, but prices took a dip on Tuesday morning. BTC dipped from over $94,500 to around $93,000, only to bounce back to its initial levels. As a result, Bitcoin and most altcoins are trading at nearly the same levels as yesterday.

In this rise and fall, XRP slumped to $2.16, but quickly leapfrogged over $2.34, making it the top performer among the top 25 cryptocurrencies.

Why is XRP On an Uptrend?

The primary reason for this upswing is the approval of three new Ripple ETFs in the USA by the SEC. ProShares' approved products include:

- Ultra XRP ETF (2x leveraged)

- Short XRP ETF

- Ultra Short XRP ETF (-2x leveraged)

These products bear resemblance to the leveraged XRP ETFs introduced by Teucrium earlier this month. Although these new products aren't the "spot Ripple ETFs" that the XRP community hoped for, the recent approvals have greatly boosted XRP's price over the weekend and Tuesday morning.

Experienced cryptocurrency analysts believe that a future spot XRP ETF could bring a groundbreaking impact on XRP's price. Some estimates project that XRP's price could even touch $100.

Secure a $600 Bonus from Binance (Exclusive Offer): Hurry up and sign up through this link to claim your exclusive $600 bonus from Binance.

Ripple (XRP) Updates Facebook Twitter LinkedIn Telegram

Insights

The recent approval of Ripple ETFs and potential future spot ETFs are propelling XRP's price through various catalysts:

Immediate Price Drivers from Futures ETFs

- Regulatory validation: The SEC's approval of leveraged XRP futures ETFs (ProShares' 2x and inverse products launching in April 2025) signifies institutional acceptance, thereby reducing regulatory uncertainty[2][4].

- Market psychology: Traders expect increased liquidity and accessibility, especially as futures ETFs historically precede spot products in the crypto markets[1][2].

- Technical breakout: XRP's price surged 40% from its 2025 lows, breaking a bullish falling wedge pattern, with analysts targeting $3.63 (a potential 55% upside)[2].

Future Spot ETF Impact

- Institutional inflows: JPMorgan projects $8+ billion in first-year inflows for XRP spot ETFs—triple Ethereum’s ETF inflows to date[1][3].

- Supply dynamics: A spot ETF could put pressure on XRP’s liquidity, as custodians might lock up tokens to back shares, potentially creating scarcity[2][3].

- Regulatory momentum: Polymarket odds for a December 2025 spot ETF approval increased to 78%, reflecting growing optimism[1][3].

Broader Catalysts

- Ripple’s banking expansion: The clarity following the SEC lawsuit has accelerated partnerships with financial institutions to replace the SWIFT infrastructure[1][4].

- Market decoupling: XRP’s price action lately seems to be dissociating from Bitcoin and Ethereum, suggesting that ETF-related speculation is driving sentiment[2][4].

A spot ETF approval would probably intensify these effects, potentially pushing XRP towards $5 if inflows match forecasts and supply tightens[1][3]. However, the SEC's delayed decision on Franklin Templeton's spot ETF (now postponed to June 2025) underscores the remaining regulatory challenges[5].

- The surge in XRP, the digital currency of Ripple, can be attributed to the recent approval of three new Ripple ETFs in the USA by the SEC.

- The SEC's approval of these leveraged XRP ETFs has greatly boosted XRP's price over the weekend and Tuesday morning.

- Experienced cryptocurrency analysts believe that a future spot XRP ETF could bring a groundbreaking impact on XRP's price, with some estimates projecting that XRP's price could even touch $100.

- A spot ETF could put pressure on XRP’s liquidity, as custodians might lock up tokens to back shares, potentially creating scarcity.