Largo Secures Lifeline for Brazilian Subsidiary, Expands into Energy Storage

Largo Inc. (TSX: LGO, NASDAQ: LGO) has secured a crucial lifeline for its Brazilian subsidiary, Largo Vanádio de Maracás S.A (LVMSA). The company has received a binding term sheet from five Brazilian lenders to defer principal repayments, allowing it to focus on strategic growth.

The agreement, signed by Interim CEO Daniel Tellechea, permits LVMSA to postpone principal repayments until March 18, 2026, with an automatic extension to September 18, 2026, provided Largo raises at least C$30 million in capital by November 17, 2025. In exchange, LVMSA will provide a negative pledge over its mining rights and equipment, pay accrued interest, submit quarterly unaudited balance sheets, and renegotiate debts with suppliers.

Largo, a global leader in high-quality vanadium and ilmenite products, is also expanding into the long-duration energy storage sector. Through its 50% ownership of Storion Energy, a joint venture with Stryten Energy, Largo is focused on scalable domestic electrolyte production for utility-scale vanadium flow battery long-duration energy storage solutions in the U.S.

The deferral allows Largo to prioritize its strategic investments, including its joint venture in the energy storage sector. The company's common shares continue to trade on the Nasdaq Stock Market and the Toronto Stock Exchange under the symbol 'LGO'. The successful capital increase in November 2025 will depend on securing shareholder approval and meeting regulatory requirements.

Read also:

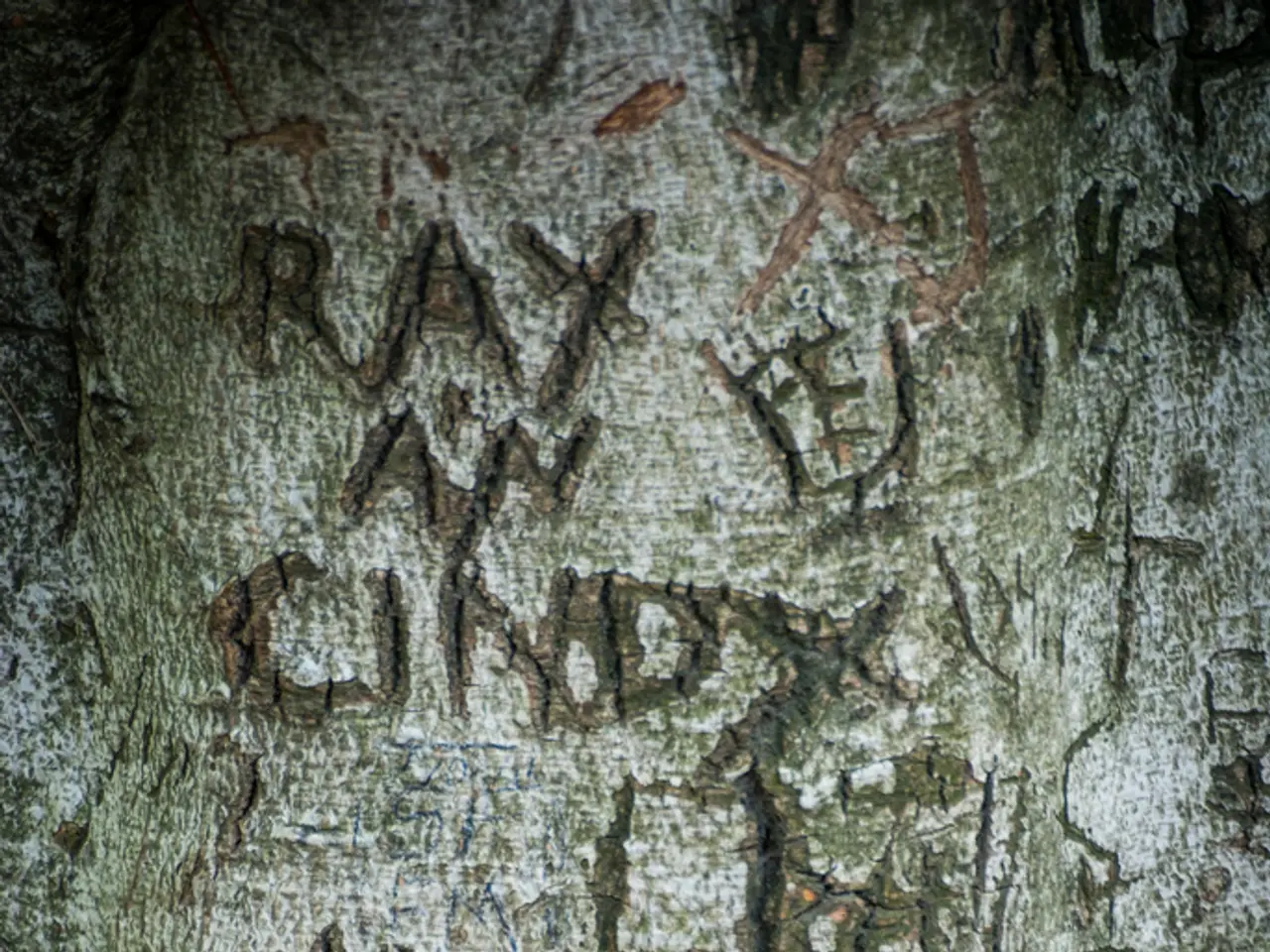

- Reporter of Silenced Torment or Individual Recording Suppressed Agony

- Solar panel troubles on rooftops

- EPA Administrator Zeldin travels to Iowa, reveals fresh EPA DEF guidelines, attends State Fair, commemorates One Big Beautiful Bill

- Musk announces intention to sue Apple for overlooking X and Grok in the top app listings