Potential Legislation Proposed by Trump Could Boost Bitcoin Expansion

The United States has recently passed a major economic bill, nicknamed the "big, beautiful bill" by President Donald Trump, which has sparked debate among politicians and economists alike. The bill, which slashes taxes for workers and businesses, could potentially add $3.3 to $5 trillion to the national debt over the next decade [1].

Democrats strongly opposed the bill, with House Minority Leader Hakeem Jeffries giving the longest speech in House history trying to block it. Despite the opposition, Trump and his allies managed to secure the necessary votes for the bill to pass [2].

The bill pushes government debt to new highs and may drive more people towards digital assets like Bitcoin. Historically, Bitcoin has attracted attention during periods of inflation and currency devaluation, as it is perceived by some investors as a store of value independent of government monetary policy [2].

Recent analyses suggest that this new U.S. fiscal stimulus package, alongside dollar weakness and rising tariffs, has shifted inflation risks to the upside [2][3]. The expectation is that inflation could remain elevated in the latter half of 2025 and into 2026, which may prompt investors to seek alternative assets like Bitcoin.

The ongoing debate over the Inflation Reduction Act (IRA) and new tax legislation introduces uncertainty. Cuts or changes to the IRA could reduce investment in green energy and manufacturing, potentially slowing economic growth and raising energy costs for households [1].

New tax legislation is projected to add trillions to the federal deficit, which could further fuel inflation concerns and pressure the dollar [2][4]. As inflation pressures rise and the dollar weakens, some investors may perceive traditional asset classes as less attractive, increasing interest in cryptocurrencies—particularly Bitcoin—as a hedge [2].

The combination of fiscal stimulus, continued low interest rates (even with possible cuts), and higher inflation expectations could create an environment where alternative investments like Bitcoin gain traction among those seeking to protect purchasing power [2][3]. However, it's important to note that market interest also depends on broader macroeconomic trends, regulatory developments, and investor sentiment.

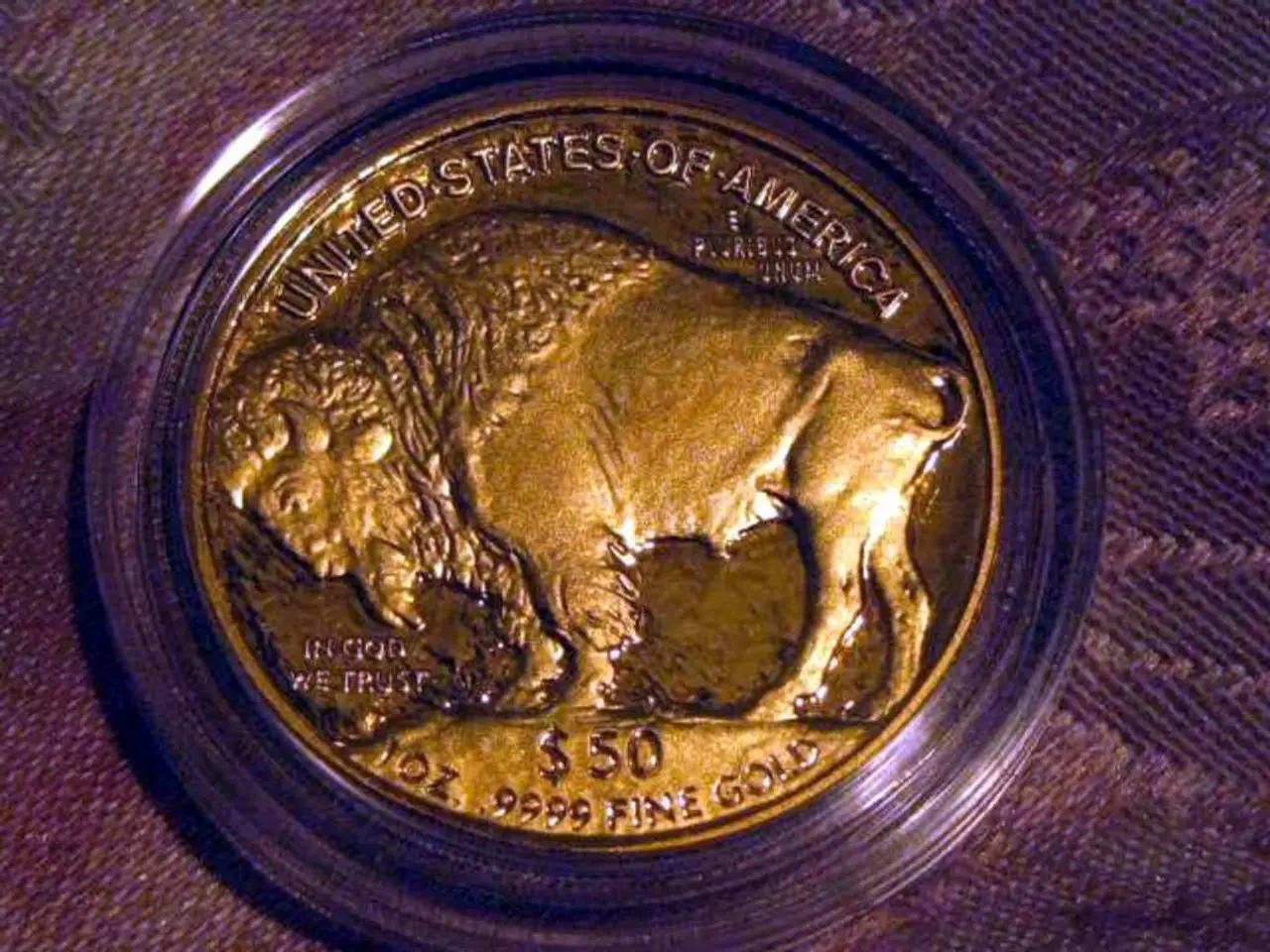

The Bitcoin price in euros is influenced by the value of the U.S. dollar. A weakening U.S. dollar can result in smaller Bitcoin gains for European investors. If inflation concerns arise, crypto, particularly Bitcoin, could benefit from a shift in investor mindset. Bitcoin is limited in supply and does not rely on any government or central bank.

As the effects of the passed bill unfold, focus is now on how markets respond. If inflation rises and the dollar weakens, Bitcoin could become more appealing as a store of value. Crypto, including Bitcoin, has increasingly become part of the conversation when inflation fears grow.

References:

[1] https://www.nytimes.com/2022/11/17/us/politics/inflation-reduction-act.html [2] https://www.cnbc.com/2022/08/01/bitcoin-price-could-benefit-from-us-inflation-and-dollar-weakness.html [3] https://www.bloomberg.com/news/articles/2022-08-01/bitcoin-and-crypto-could-get-a-boost-from-inflation-and-a-weaker-dollar [4] https://www.axios.com/2022/11/17/us-debt-to-rise-by-as-much-as-5-trillion-due-to-economic-bill

- As the United States initiates a shift towards fiscal stimulus, accompanied by rising inflation and a potential weakening of the dollar, an increasing number of investors might consider alternative assets such as Bitcoin, given its reputation as a store of value independent of government monetary policy within the realm of technology and finance.

- The passage of the economic bill in the United States, which has the potential to increase inflation risks and pressure on the dollar, could spark renewed interest in digital assets like Bitcoin, particularly among those looking for a hedge against traditional asset classes in an environment of uncertain business and financial conditions.