Bullish vibes brewing for Cardano (ADA) as technical patterns and address growth hint at a breakout at $0.7477

Prospects of Cardano's surge - Navigating the path for ADA to re-attain $0.7477 value

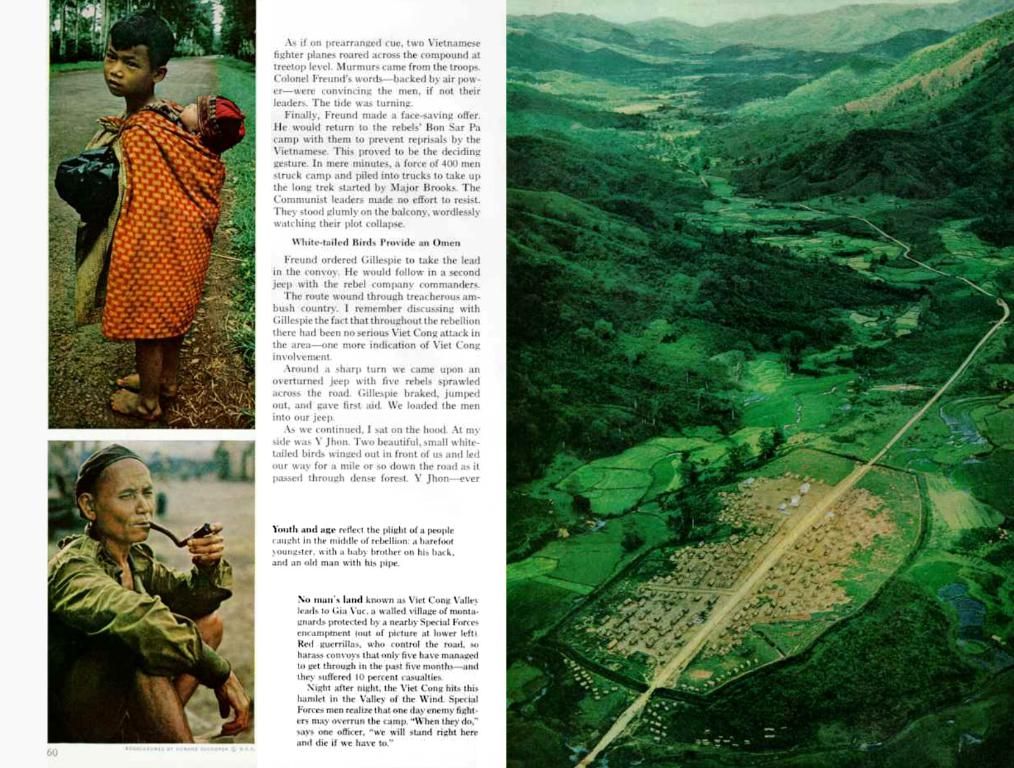

Cardano (ADA) is catching some fresh winds as crypto investors and traders smell a possible price surge coming. The digital asset is attempting to form a bullish reversal known as an inverse head-and-shoulders pattern, according to Market Prophit. If successful, it'd be a sign of things to come for ADA.

At the time of writing, ADA is going for $0.6875, having lost 2.06% over the last day. But don't be thrown off, as it's holding above critical structure levels, a sign that bullish pressure may amp up further.

ADA's reverse pattern pointing towards a potential breakout

A clear-as-day inverse head-and-shoulders pattern is taking shape on the ADA daily chart, and the neckline rests comfortably at $0.7477. Breaking this neckline resistance will often lead to bullish reversals. Right now, ADA is squeezing below this level, hinting at indecision, but a breakout could send the price skyrocketing.

Source: TradingView

Address growth and liquidation battles: ADA's demand standing firm

Binance's recent liquidation heatmap revealed dense clusters of sell pressure and leveraged positions right under the $0.70 mark. This area is becoming a magnet for sell-offs, with traders gearing up for a fight. If ADA overcomes this hurdle, forced liquidations could unleash a buying frenzy. But if it gets rejected here, bearish forces might keep control.

However, it's worth noting that historical dips have usually seen quick absorption, indicating a hidden demand.

On the other hand, on-chain address data reveals that the number of new addresses, active addresses, and zero-balance addresses have significantly increased over the past week. These indicators suggest rising user engagement and speculative interest, which can fuel long-term price appreciation.

Source: Coinglass and IntoTheBlock

Is Cardano ripe for a sustainable breakout?

Santiment's MVRV Z-score for ADA currently stands at 0.056, suggesting that the token is undervalued compared to its historical average. With minimal profit-taking pressure, there may be room for growth without triggering large-scale sell-offs.

Traditionally, MVRV levels above 1 signal rich profits that are prone to a correction. But ADA's current level is rather neutral, indicating a more steady growth.

With declining leverage in the options market, sudden volatility should subside, and over-leveraged positions could be flushed out, paving the way for healthier price discovery.

Will ADA flip the $0.7477 resistance and maintain the breakout?

With sentiment strong, address growth accelerating, and technical patterns aligning, Cardano may be on the brink of a possible breakout. The $0.7477 neckline is the make-or-break point. If buyers manage to flip this level into support, Cardano might enter a new phase of bullish momentum. However, failure at this juncture could prolong the consolidation.

For now, the bias remains bullish. But confirmation will hinge on ADA's ability to break and hold above $0.7477.

- The bullish outlook for Ethereum (ETH) may intensify as the DeFi (decentralized finance) sector's growth and the successful launch of EIP-1559 could boost its price.

- As Cardano (ADA) stakes its claim for a breakout, investors are keeping an eye on Cardano's reverse pattern and the confrontation between address growth and liquidation battles.

- The future of Cardano (ADA) and other crypto tokens, such as Ethereum (ETH), isn't just about technology or investor sentiment; it's also about the complex interplay between technical patterns, on-chain metrics, and market dynamics.

![Altered image portrayal: Prominent figure accused of privacy breach and data misuse Bullish sentiments are rekindling interest in Cardano [ADA], with both public investors and sophisticated money managers expressing optimism.](https://techstreamtoday.top/en/img/20250512185054_pexels-image-search-headline-image-description.jpeg)